Micro e-mini futures are micro contracts within the futures market. Micro e-mini contracts are 1/10th the size of a classic e-mini contact. When the CME Group released this new contract, it didn’t get the hype that the product deserves. In fact, the implications of what micro e-mini futures allow regular traders to do are nothing short of phenomenal.

What Are Micro E-Mini Futures?

Micro e-mini contracts represent the same high-quality products available in the futures market but at a 10th of the size. This allows those with a lower capital to start an active trading business in the futures market.

Micro contracts make high-quality trading options more accessible to those who want to get involved. For example, even the S&P 500 now has a micro contract known as the MES. Micro contracts have been out for a little while, but they are still relatively new. Still, not enough people have looked into micro contracts and transitioned into using them.

Benefits of Trading Micro E-Mini Futures

So if you’re interested in trading micro contracts, of course, you want to know the benefits associated with trading them. Here are some key reasons that we love micro e-mini futures and why we think you will too.

No Reason to be Trading Full Size Contracts

If you are interested in trading in the futures market, you shouldn’t trade full-size contracts if you are not consistent. That makes micro contracts a great option while you are getting comfortable trading futures and building up consistency.

If the PnL (Profit and Loss) really worries you, that would be a reason to stick with full-size contracts. However, if you focus too much on the PnL, you will stretch out the learning curve.

Access to a Superior Product Like Futures With Less Capital

The most important thing to remember about micro contracts is that they give you access to a superior product with less capital. That fact alone makes micro contracts worth your consideration, and if you’re interested in trading in the futures market, then micro e-mini futures are the product for you.

Not to mention, small accounts have the ability to work their way up to full size contracts by trading micro contracts, but more on that later.

Things to Keep in Mind

Micro contracts are an exceptional tool for small trading businesses or accounts, but there are some important things to keep in mind.

Here’s what you need to know before you get started with trading micro contracts.

Don’t Chart or Analyze With Micro Contracts

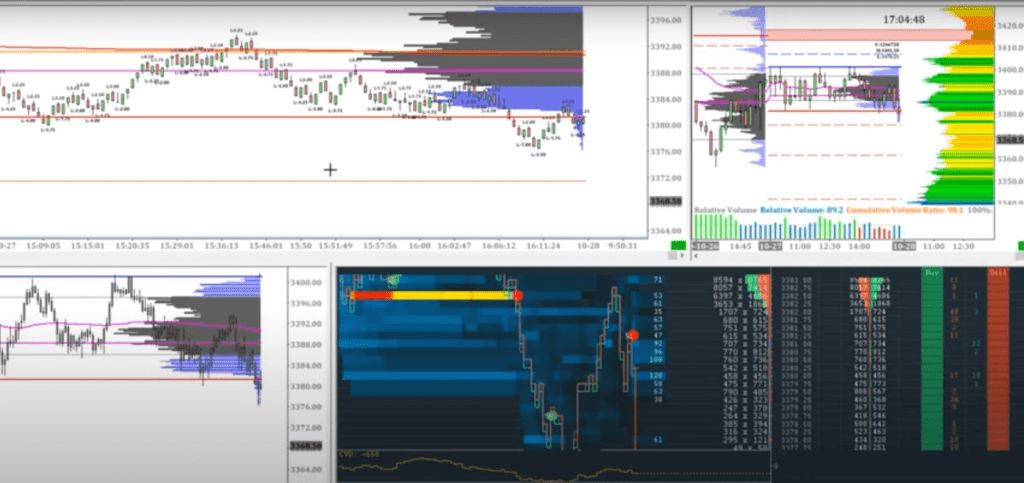

There are a couple of reasons that you should chart and analyze full-size contracts instead of micro contracts. Analyzing full-size contracts is how you should put the story together and come up with trade ideas.

In terms of the volume profile, the micro contracts will not give you a perfectly accurate representation. Certain high and low-volume areas will be different on a micro contract compared to a full-size contract.

Even something like where the point of control is, or where the value area high or low is, that kind of information will be different. Typically, the data on micro contracts isn’t that far off from the full-size contracts, but it is enough to where you should be analyzing full-size contracts instead.

Fees and Commissions Will Be More, but It’s Worth It

One downside with trading micros is that the expense associated with the transactions will be greater than if you were to trade a full contract. When you understand the tick value between a full contract and a micro contract, you will figure out with accuracy that trading micro contracts is about 3x more expensive than trading full contracts.

However, as the popularity of trading micro contracts increases over time, it is safe to assume that the gap between expenses will narrow. Of course, these expenses will come in the form of fees and commissions.

Even considering the extra fees and commissions that come with micro contracts, they are still worth trading. The ability to access a superior product like the futures market with a small amount of capital makes the commissions worth it and leaves you with nothing to complain about.

Another important point is that the extra fees and commissions won’t make a big difference on a small scale, but they will as trading scales up. For example, if you were trying to trade 70-80 micro contracts simultaneously, you would run into some issues with the fees and commissions. As your trading business or account scales up, you shouldn’t be using micros anymore, and you can transition into full contracts.

The Bottom Line

Micro contracts may seem intimidating at first, but really they’re just a way to get a small amount of exposure to a superior product, such as the futures market. Micro e-mini futures are 1/10th the size of the full contracts and allow you to trade the futures without taking on too much exposure.

Unfortunately, micro contracts are more expensive to trade, with their fees and commissions about 3x full contracts. However, we believe that the ability to access superior products with smaller amounts of capital makes the cost worth it. Additionally, as the value of an account grows through consistent trading, you can move up to full-size contracts.

Keep in mind that you should perform data analysis and chart with full-size contracts if you decide to trade micro-contracts. The data will be slightly more accurate than that of micro contracts. This is true for data types such as volume, value area, point of control, and more.

If you liked this article, check out our in-depth free training here.

TradingView Tutorial for setting up the Volume Profile

Watch Your Risk & Happy Trading!

-Korbs

Micro E-Mini Frequently Asked Questions (FAQ)

How Much Capital You Need for Trading E-Mini Futures?

To start trading E-Mini Futures contracts, you need a starting capital of at least $500 with the S&P 500 Futures. They have the lowest trading margins but keep in mind you might need a little more to keep the contract going assuming there are price fluctuations.

How Many E-Mini Contracts Can You Trade?

You can trade up to 5 contacts with a minimum $500 margin for each contract, with a $2500 account. However, this is not smart to do since it increases the trader’s risk a lot.

What Happens if a Futures Contract Expires?

When the futures contract that you have expires, then the position automatically closes. If you close above the entry point, you’ve made a profit; if you close below it, then you have made a loss.