Good morning ,

I hope you didn’t fight the action yesterday as we prepared for today’s CPI data.

Seems the market sold off as people were fearful of a bad number today.

But that’s for tomorrow’s email.

Today I’ve got a lil lesson on a little-known statistic for you.

And it’s this…

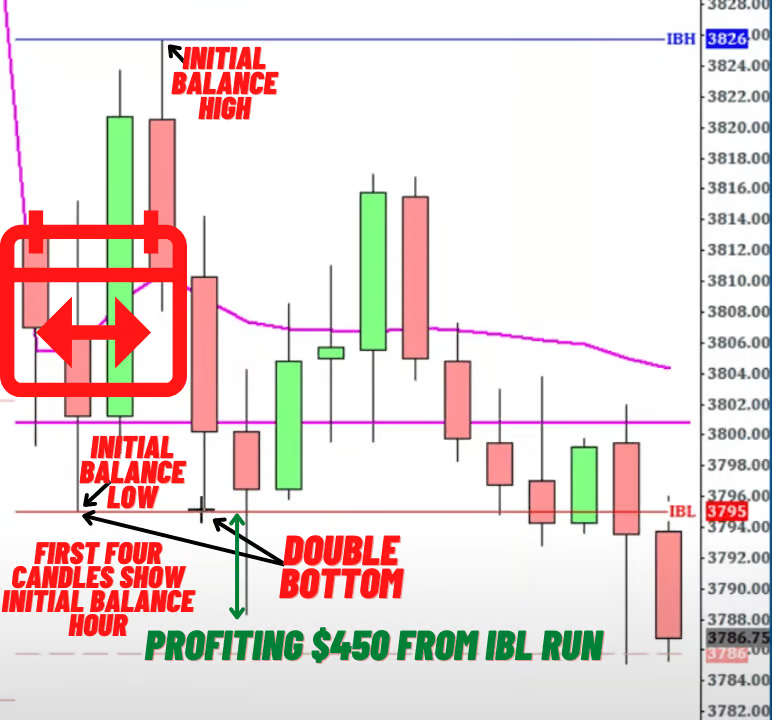

If the initial balancing hour of action looks like it’s about to get broken down but it holds…

Stopping to the TICK…

And reverses back up?

Don’t worry.

There is a very strong likelihood of not only a return to the Initial Balance Low…

But a considerable move past it as stops get run.

Yesterday this is exactly what happened:

Even though I was already short…

The bounce off IBL didn’t make me lose confidence in my trade…

Because the market likes to conclude unfinished business…

Whether that’s finishing unfinished auctions,

Filling in gaps made during extended trading hours,

Or a double bottom at initial balance low.

As long as we were still breaking down under my profile’s value area I was happy to wait and see the double bottom get run.

When we did break down I exited for $450 on the day.

It could have been more but due to some extra volatility, I got shaken out a little early.

I guess the fear in the market got to me as well haha.

But…

Profit is profit and I am grateful for what I do.

So no complaints from me 😉

Be careful today,

Stat-Master Korbs.

P.S.: We have a couple of weeks left on the calendar until Black Friday.